China: It's Not About Economics

SEARCH BLOG: ECONOMY and POLITICS Recently, I attended a meeting at the Westland AMVETS where Jack McHugh

of the Mackinac Center for Public Policy was giving a presentation. Jack and I had not met before then although we communicated occasionally by email. I have great respect for Jack's work and opinions, but we have have one slight difference in our viewpoints: China. Jack even acknowledged that in a friendly, off-hand remark at the meeting.

Jack and I both believe in the benefits of free trade. Where we differ with regard to China is my opinion that trade with China is highly manipulated by China to the detriment of U.S. manufacturers and is done so because China's interests are strategic first and economic second.

Jack rightly points out that manufacturing has been a declining segment of the U.S. economy for decades as it regards employment. It is a function of production efficiency that fewer workers are required to produce more goods. Besides, no one wants to be a production worker... do they? In my mind, that is not the point entirely. Trading with China is unlike trade with Germany or India or Brazil.

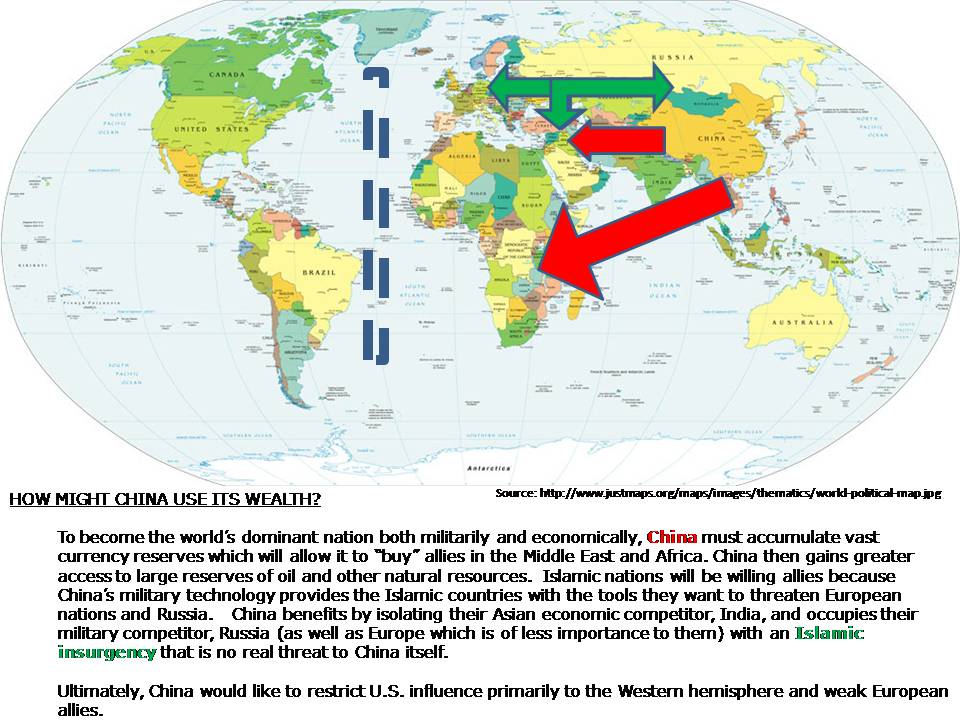

China has a far-reaching goal in which trade is simply a tool to be used in any way that gains a strategic advantage.The series of posts dealing with this strategic goal is summarized here, but this is the key graphic:

A few days ago, the British online paper Telegraph wrote:

China views trade as the hammer for its long-term strategic goals... and the U.S. is just another nail to be pounded. While others like Jack and the Telegraph view trade with China as primarily economic in nature, I continue to view it as a strategic struggle for power with the economic aspect as the "red herring."

China has succumbed to hubris. It has mistaken the soft diplomacy of Barack Obama for weakness, mistaken the US credit crisis for decline, and mistaken its own mercantilist bubble for ascendancy. There are echoes of Anglo-German spats before the First World War, when Wilhelmine Berlin so badly misjudged the strategic balance of power and over-played its hand.

Read full story....

Will China ultimately fail in its efforts because the "economics" of what they are doing are against them? I'm not holding my breath.

ADDENDUM:

Jack's email response:Good stuff.I don't disagree that with China, "the economic is the geopolitical," but I certainly wouldn't characterize the economic competition as a "red herring," and here's why: It would be just as fair to say that with China "the geopolitical is the economic." IOW, one is not the second fiddle to the other; rather they are two faces of a single holistic entity, The Middle Kingdom.In China's view it is only right and proper that the largest country with the oldest civilization - whose people are bloody smart and endowed with a Confucian work ethic that makes everyone else including us look like slackers - should become the preeminent world economic power. Naturally, with that position comes strategic geo-political concerns, just was the case with Britain in the 19th C, and the U.S. in the 20th. Like the U.S. in the 20th C, China doesn't have imperialistic territorial aspirations beyond its periphery, but that doesn't mean it has no interest in mucking around in distant places in furtherance of its interests.As I said in an earlier exchange, in the 20th C China was stupid and poor, but it was unrealistic to think they would stay that way forever.The Middle Kingdom is a tough, worthy competitor in both the economic and the geo-political realm. No they don't "play fair" according to conventional western conventions. In their pursuit of economic and geopolitical preeminence they aren't inhibited by the kind of moralistic considerations that often enliven foreign policy debates in this country. One might think of them as an Asian "France" in this regard.We can't take our marbles and go home when they behave in ways we don't like. If we raise restrictive trade barriers, that will make us poorer and less capable of competing. If we whine and beg, "Can't we all just get along," that will be correctly interpreted as weakness and opportunity.

So what can we do? Get in the game, economically and geo-politically. Sharpen up our game on both fronts. How? Cato Institute and the Mackinac Center have the domestic economic agenda for that. Organizations like the Center for Strategic and International Studies have the program on the geo-political front.

I suspect that Bruce Hall and I have no fundamental disagreements on this part.Jack McHugh