Why China Subsidizes Us

SEARCH BLOG: CHINA

Along with the problems in the housing market, the latest employment statistics unnerved Wall Street on Friday. While the financial markets bounce around, the downward trend for housing and employment may continue and worsen for awhile.

Some will see an employment downturn as a result of shipping off jobs to China. Maybe; maybe not. But let's talk about trade with China and, perhaps, a Chinese hidden agenda.Many claim that China is "subsidizing" the U.S. by selling goods to us that are far cheaper than we could produce domestically.

That may be from a purely economic perspective, but one must ask the basic question: why is China being so altruistic toward an ideological competitor?Before we look at that, perhaps an historical perspective is helpful. This is a chart showing the major employment sectors in the U.S. over time:

The U.S. has moved from a producing [farming, manufacturing] to a consuming [services] employment economy.

One must recognize the impact of efficiency. While fewer people are employed in farming than ever before, technology has increased efficiency so dramatically that more food than ever is being produced by fewer people than ever. Likewise, manufacturing is dramatically more efficient than ever before. Simply put, fewer people are needed for manufacturing.So the employment opportunities are focused on continued improvement of efficiency or raising the quality of life.

But that doesn't answer the question about why China is being so altruistic about "subsidizing" the U.S. with cheap goods.

First of all, China is struggling to get to the point the U.S. was in 1950-1960. An enormous portion of its 1.3 billion population is still in agriculture... "dirt poor" as it were. Increasing manufacturing is its next step to wealth. Even so, the absolute output of China's manufacturing is amazing considering where it was two decades ago.Then is increasing the living standard of its people the reason that China is "subsidizing" the U.S.?

In order to believe that, one must believe that China has converted to a market economy from a centrally-controlled economy so that it can create opportunities for wealth for its population. Evidence indicates that may be the case... in some part. There are an increasing number of millionaires and billionaires in China.Does that also mean that China's power elite have converted from a Marxist philosophy to a capitalist philosophy?

I'm not convinced that is the case. Capitalism and central government management of the economy are not necessarily compatible. But limited capitalism may be a tool to be employed by a power elite... especially when the labor used to power the limited capitalism is powerless to demand anything. Some might argue that China's policies might be closer to mercantilism. Regardless, rather than accumulating gold and silver, classic mercantilism, the Chinese are accumulating the world's currency... U.S. dollars. The nation is gaining wealth, but not necessarily the whole population.What this means is that "China" is not subsidizing the U.S.. Rather it is the Chinese laborers who are subsidizing the U.S. in order to build U.S. dependency on Chinese manufacturing... in order to build wealth for the Chinese government.

But are not many Chinese citizens becoming very wealthy?

Yes, within the constrains of the government control. Party leaders also are becoming more economically powerful as the government itself raises vast amounts of U.S. currency reserves.So, increasing wealth is the Chinese end game?

I think not. Wealth is a means to an end.What might that end be?

Power and influence.For example?

- Money to buy influence among U.S. politicians

- Money to buy influence among U.S. corporations

- Money to obtain technology for military upgrading

- Money to create modern military products using the technology obtained by influencing U.S. politicians and corporations

- Money to expand its upgraded military

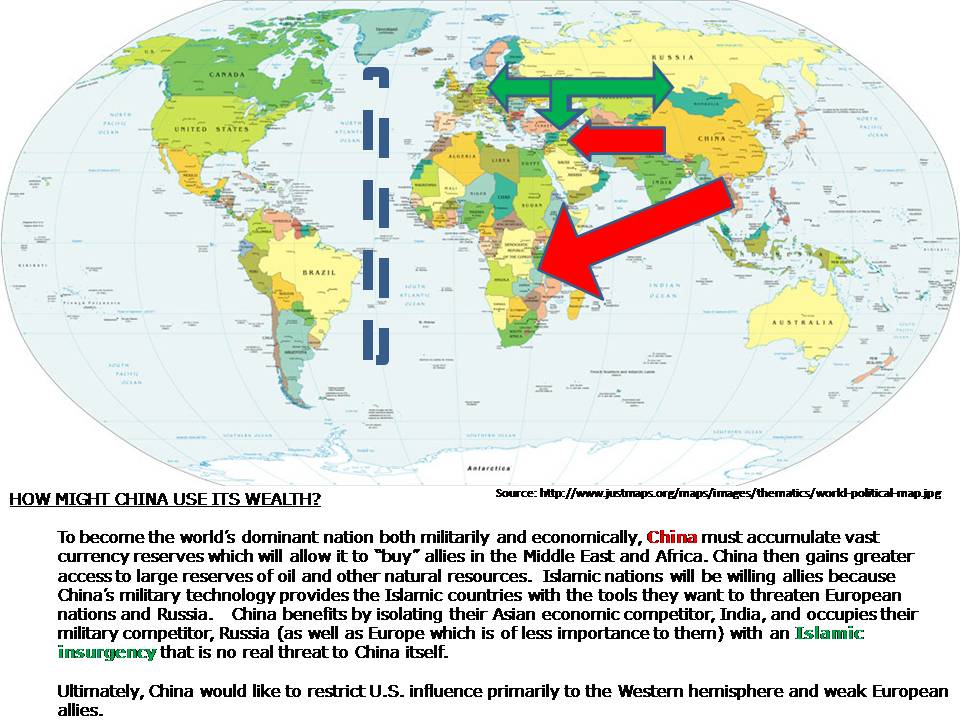

- Money to provide weapons "aid" to potential allies willing to act as proxies against the U.S. and, possibly, Russia so that China becomes the dominate military influence in Asia and Africa.

China's government is not "communist" in that it is not a "people's government." It is a feudal government of powerful elite, wealthy families that maintain the facade of a "people's government." It's strategy is to dole out just enough of the increasing wealth to placate its population without ceding any power.So why is China "subsidizing" the U.S.?

Perhaps they are taking some pages out of the book from this man.Wealth is but a means to an end. The U.S. might want to ask, "The end of what?"

I know, I'm just another one of those conspiracy nuts.

..